Income tax calculator for retired person

Income tax exemption limit is up to Rs3 lakh. Taxation of social welfare payments.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 2021-22 and 2022-23 tax years. This calculator only provides you with an indication of the tax you may have to pay based on rates and allowances which apply to the 202223 tax year. Age UK no longer provides a tax calculator.

This document is in. Prepare For Your Future Today. Go to HMRC tax calculator.

Discover The Answers You Need Here. Tax information for seniors and retirees including typical sources of income in retirement and special tax rules. When you received your Form W-2 Wage and Tax Statement prior to retirement you reported your wages on an individual income tax return such as Form 1040 US.

Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Based on your projected tax withholding for the year we can also estimate.

Special taxation arrangements apply to people aged 65 and over. The good news is. Ad Get Personalized Action Items on What Your Financial Future Might Look Like.

WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov. Effective tax rate 172. Reconcile Child Tax Credit Payments If.

Your 2021 Tax Return. For a single person making between 9325 and 37950 its 15. Enter your filing status income deductions and credits and we will estimate your total taxes.

Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Free step-by-step webinar September 19.

Dont Wait To Get Started. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

4 of income tax. Start Today With Our Free Easy to Use Online Chat. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

The calculator will calculate tax on your taxable income only. Rs5 lakh - Rs10 lakh. For those with an income below the listed thresholds you may not have to pay taxes.

A single person making between 0 and 9325 the tax rate is 10 of taxable income. That means that your net pay will be 40568 per year or 3381 per month. 4 of income tax.

Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Ad Top-rated pros for any project. Instead we recommend you use the HMRC tax calculator to check youre being correctly taxed.

Income tax credits and reliefs. Income Liable to Tax at Normal Rate --- Short Term Capital Gains Covered us 111A 15 Long Term Capital Gains Covered us 112A 10. Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars.

Your household income location filing status and number of personal. Ad Its Time For A New Conversation About Your Retirement Priorities. Ad Track Your Progress Journey Towards Financial Freedom With Jacksons Planning Tools.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Our Tool Can Help You Find Answers To Important Retirement Planning Questions. IR-2019-155 September 13 2019.

Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. You may also use the Tax Calculator for Resident Individuals XLS 96KB to estimate your. Your average tax rate is.

It takes into account income related. Ad TIAA Can Help You Create A Retirement Plan For Your Future. Surcharge is applicable if total income is more than.

2022 Income Tax Brackets And The New Ideal Income

Tax Withholding For Pensions And Social Security Sensible Money

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

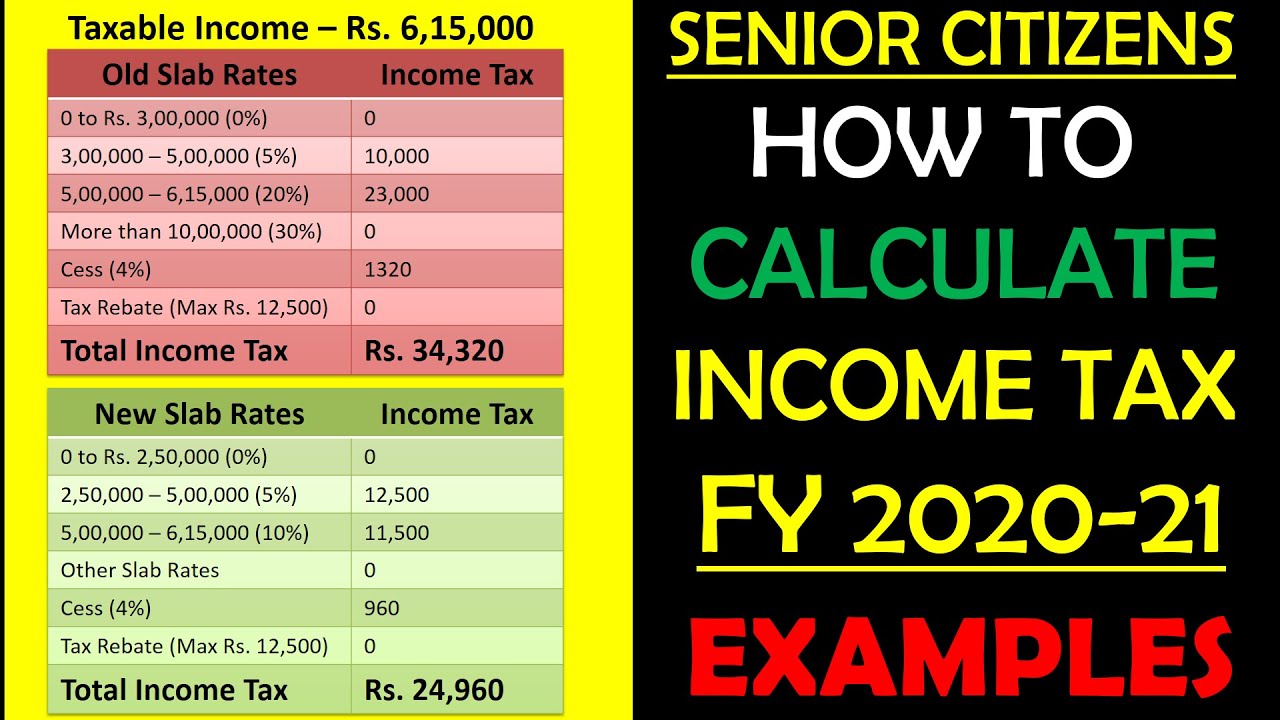

Income Tax Calculation Senior Citizens 2020 21 How To Calculate Income Tax Senior Citizens 2020 Youtube

How I Retired At Age 30 With 500 000 Saved Personal Finance Advice Early Retirement Budget Advice

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Retirement Income Connecticut House Democrats

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

2022 Income Tax Brackets And The New Ideal Income

Tax Calculator Estimate Your Income Tax For 2022 Free

Income Tax Definition What Are Income Taxes How Do They Work

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Connecticut Retirement Tax Friendliness Smartasset

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

2022 Income Tax Brackets And The New Ideal Income