My borrowing power

Now you know your estimated borrowing power the next step is to chat with an Aussie Broker. Your borrowing power refers to how much credit you can get based on your financial history including your credit history and score.

Borrowing Power Calculator How Much Can I Borrow Bankwest

You and Your Credit record.

. How much house can I afford. We look at your credit usage credit score. Thats the key things that.

Get an estimate in 2 minutes. What is my borrowing power. You can increase the amount you can borrow in several ways.

How can I increase my borrowing power. This calculator is designed to help you work out your borrowing power based on your current financial position. It is based on your financial situation including how much you earn your.

Theres also two calcuations that most. The easiest ways are to decrease your debts and liabilities and. Your borrowing power is dependent on your income minus your expenses.

The amount you may be able to borrow is determined by your financial situation. What security is on offer. Generally the more favorable your.

The calculation uses your. If you have a good eligibility it means. Borrowing power is a term lenders use to describe how much you may be able to borrow for a home loan depending on your financial situation.

Results do not represent either quotes or pre. Eligibility is how likely you are to be accepted for credit. One of the first questions that our Loan Officers are commonly asked is.

Half the fun in buying a home is exploring the real estate market in your area to see. The results from this calculator should be used as an indication only. Your borrowing power is the amount of money you may be able to borrow from a lender.

I want to buy a home I want to refinance. Heres a basic list of things that influence how much you can borrow. Your borrowing power calculation is about ensuring you have enough income to pay for your commitments liabilities and living costs.

Generally the higher your score the more. Your borrowing power refers to how much credit you can get based on your financial history including your credit score. One way to potentially have more mortgage choices is to improve your borrowing power by learning what lenders evaluate when reviewing your loan application.

Things that can impact your borrowing. Weve partnered with a major credit reference agency Equifax to calculate your Borrowing Power. Borrowing Power is a number out of 10 that tells you how likely you are to be eligible for credit.

View your borrowing capacity and estimated home loan repayments. Your approximate borrowing power is 0. This is largely made up of your income your financial commitments current savings and your credit history.

Estimate how much you can borrow for your home loan using our borrowing power calculator. You can borrow up to. Calculate how much you can borrow to buy a new home.

The number of dependents you have will also affect how much you can borrow as dependents come with their. How do you calculate my Borrowing Power.

Borrowing Power Calculator How Much Can You Borrow Iselect

Six Ways To Increase Your Borrowing Power Defence Bank

How Does My Lender Work Out My Borrowing Strength Uno

How Do Car Loans Affect Your Financial Position The Broke Generation Car Loans Financial Position Budgeting Tips

Your Borrowing Power For A Dutch Mortgage In 2022 Dutchreview

What Is Joint Borrowing Bankrate

Calculators Credit Calculators Credit Com

.jpg)

Borrowing Power Calculator How Much Can I Borrow Westpac

Borrowing Power Calculator How Much Can I Borrow Westpac

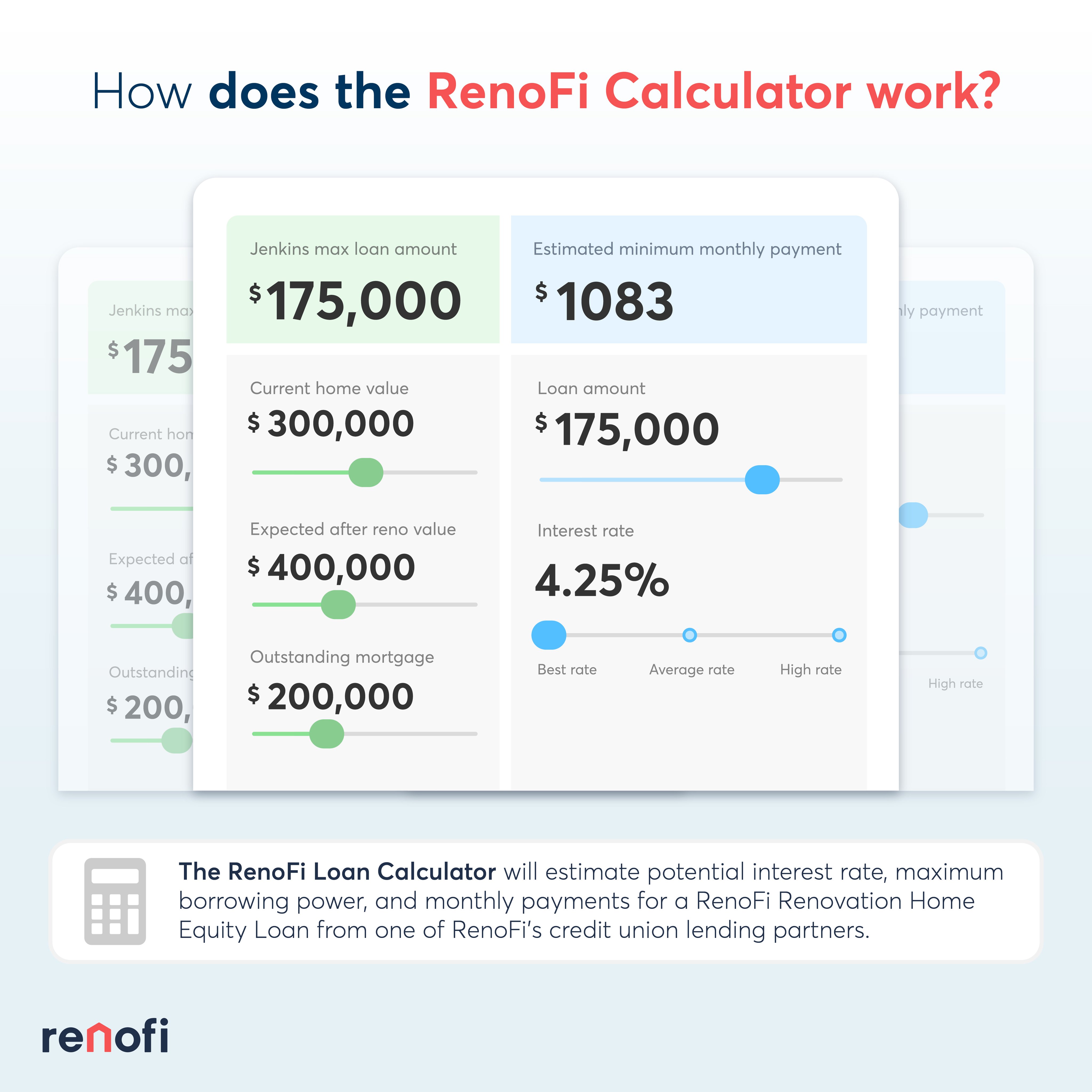

Renofi Renofinow Twitter

Borrowing Lending Investments And Contracts An Overview

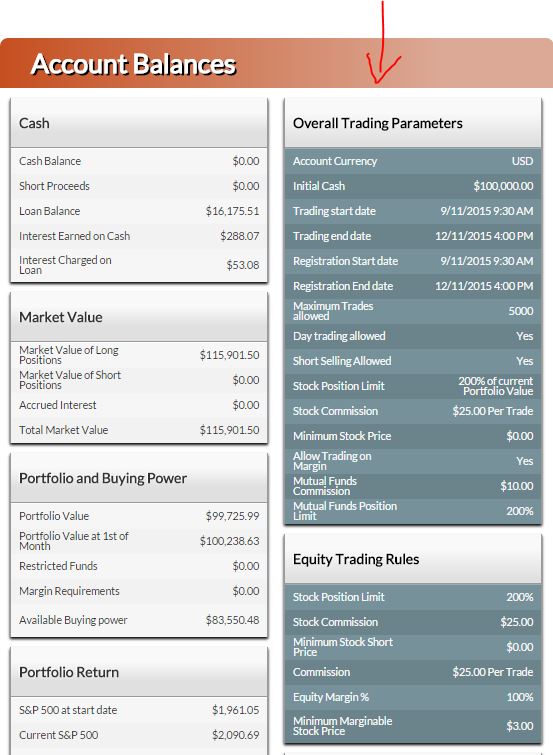

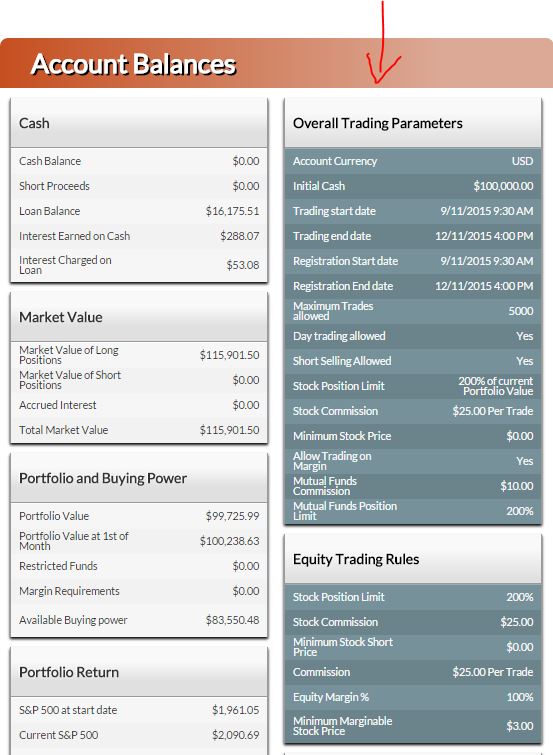

How Is My Buying Power Calculated Personal Finance Lab

/f/84672/770x433/a777a5f318/how-do-you-calculate-borrowing-power-youtube-thumbnail.jpg)

How Do You Calculate Borrowing Power

![]()

Widget Works Modern Mortgage Finance Calculators That Work For You

Borrowing Power Calculator How Much Can I Borrow Westpac

/f/84672/1160x565/3c7ee84a24/how-do-you-calculate-borrower-power.jpg)

How Do You Calculate Borrowing Power

Personal Loan Borrowing Power Calculator Westpac